The Rise and Potential of Artificial Intelligence in Stock Market Prediction Artificial Intelligence (AI) has revolutionized various sectors, and the stock market is no exception. With its ability to analyze vast amounts of data and detect patterns, AI is increasingly being utilized for stock market prediction. This article explores the role of AI in stock market prediction, its applications, benefits, challenges, and the future outlook.The Rise and Potential of Artificial Intelligence in Stock Market Prediction

Understanding AI in Stock Market Prediction

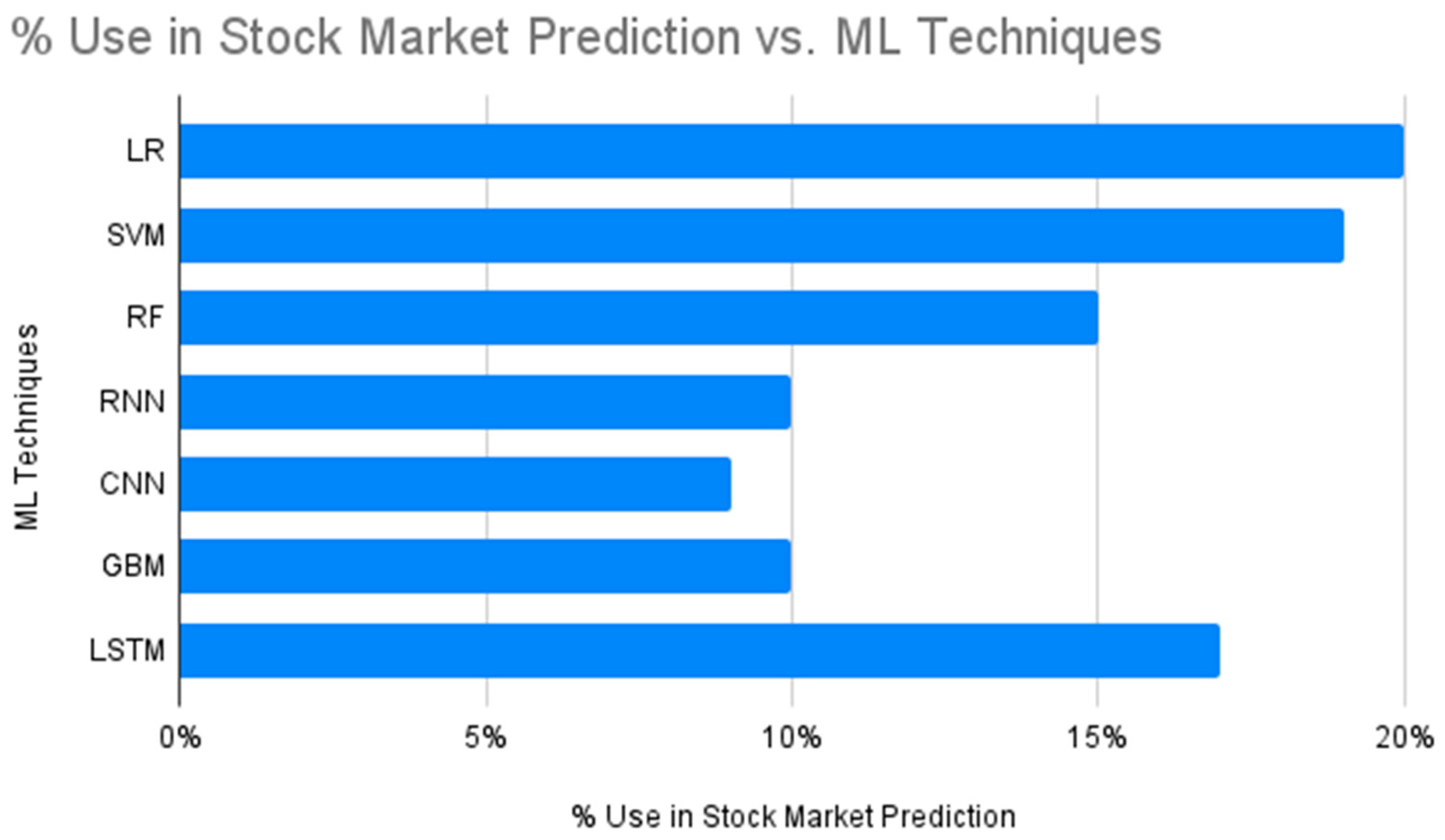

AI utilizes complex algorithms and machine learning techniques to analyze historical data, market trends, news sentiment, and other relevant factors to predict stock prices. Unlike traditional methods, AI can process huge datasets in real-time, identify correlations, and adapt its models based on changing market conditions.

Applications of AI in Stock Market Prediction

- Algorithmic Trading: AI-powered algorithms execute trades based on predefined criteria, such as price movements, volume, and technical indicators.

- Sentiment Analysis: AI analyzes news articles, social media posts, and other sources to gauge market sentiment, which influences stock prices.

- Pattern Recognition: AI identifies patterns in historical data that human analysts might overlook, helping predict future price movements.

- Risk Management: AI models assess risk factors and optimize investment portfolios to minimize losses and maximize returns.

Benefits of AI in Stock Market Prediction

- Increased Accuracy: AI can analyze vast amounts of data with speed and accuracy, leading to more precise predictions.

- Real-time Insights: AI provides real-time insights into market trends and potential investment opportunities, enabling traders to make informed decisions promptly.

- Risk Mitigation: AI models can identify and mitigate risks, helping investors avoid significant losses.

- Automation: AI automates the trading process, reducing human error and emotional biases.

Challenges and Limitations

- Data Quality: AI relies heavily on data quality, and inaccuracies or biases in the data can lead to erroneous predictions.

- Market Volatility: Sudden market fluctuations can challenge AI models, as they may not always account for unpredictable events.

- Overfitting: AI models may overfit to historical data, resulting in poor performance in real-world scenarios.

- Regulatory Compliance: The use of AI in stock market prediction raises regulatory concerns regarding fairness, transparency, and market manipulation.

The Future Outlook

Despite challenges, the future of AI in stock market prediction looks promising. Advances in machine learning algorithms, data quality, and computing power will further enhance the accuracy and efficiency of AI models. Moreover, the integration of AI with other technologies like blockchain and quantum computing holds immense potential for revolutionizing the financial markets.

Conclusion

Artificial Intelligence is reshaping the landscape of stock market prediction, offering unprecedented insights and opportunities for investors. While challenges exist, the benefits of AI in terms of accuracy, speed, and risk mitigation are undeniable. As AI continues to evolve, it will play an increasingly vital role in shaping the future of finance, transforming how we predict and navigate the complexities of the stock market.